DENIED! CO 22-This care may be covered by another payer, per coordination of benefits?!?

Date Posted: Wednesday,

October 05, 2022

Coordination of benefits can be described as when two or more insurance plans work together to determine the order of coverage liability. This coordination between plans exists to avoid duplicate payment, which could result in a provider receiving payment in excess of the services provided and the total amount billed.

In circumstances where there is more than one potential payer, not submitting claims to the proper payer will lead to denial reason code CO-22, this care may be covered by another payer, per coordination of benefits.

The National Association of Insurance Commissioners (NAIC) offers a wealth of knowledge on coordination of benefits.[1] For example, the NAIC website posts the rules of coordination of benefits and the procedures to be followed by a secondary plan.

There are many different scenarios that would require coordination of benefits.

If a married couple both have their spouse covered with their group (through their employer) or individual coverage (through an independent insurer or Healthcare.org), each policy where the patient is the primary policyholder would be the primary payer, and the policy where the patient is a dependent would be the secondary. If this married couple had children, the parent with a birthday (month/date) first in the calendar year would be primary. This is called the "birthday rule." The other parent's coverage would be secondary. Should the parents have the same birthday (month/day) then the policy with the longest effective date would be considered primary. With the implementation of the Affordable Cares Act (ACA), parents can cover their dependents on their insurance plans until the age of 26, regardless of student or marital status of the dependent.

When the family unit is complex or the type of insurance is not your standard group or individual plan, the benefit coordination may get complicated. For example, in the scenario above, if one of the parent's coverage is provided by Consolidated Omnibus Budget Reconciliation Act (COBRA), then the non-COBRA plan would be primary, and the COBRA would be the secondary payer, regardless of the birthday rule. If the parents are divorced, coordination is dependent on who is the custodial parent or the parent whom the child spends the most time with, their coverage would become primary and the non-custodial parent's policy secondary. There is an exception to that advice, if the custodial parent has an individual policy or COBRA and the non-custodial parent has a group policy, the group policy would be considered primary. As if that wasn't confusing enough if the custodial parent re-marries, then the stepparent's policy would be reported secondary and the non-custodial parent's plan would be the tertiary payer. Of course, a divorce decree (court order) can override these rules, as well as individual state laws involving minors and custodial parents.

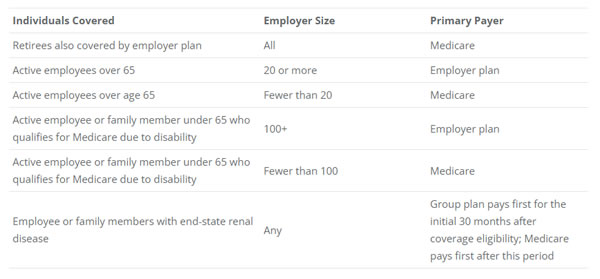

Patients covered by Medicare by retirement, disability, or due to end-stage renal disease (ESRD) have their own detailed coordination of benefits rules. When a patient retires but continues to be covered by an employer group plan, Medicare should be considered the primary payer, and the retirement group coverage is secondary. If the retired individual is working or the patient is covered by a working spouse, and insurance benefits are provided by their employer who has more than 20 employees, then the employer group plan is primary and Medicare is secondary. If the employer has less than 20 employees, Medicare should be considered primary. A patient who is covered by Medicare due to a disability and they are covered (or eligible for coverage through a family member) by an employer plan (who employs 100 or more employees) then the employer plan is primary and Medicare is secondary unless there are less than 100 employees, then Medicare is primary. An employee or family members with ESRD, with employer coverage, regardless of employer size, the group plan must cover the initial 30 months after coverage eligibility then Medicare pays first after this period.[2]

Claims for work-related injuries or illnesses should be sent to the reported worker's compensation coverage for care directly related to the job-related injury. If workers' compensation does not make a decision regarding claim payment within 120 days, the claim can be submitted to Medicare and Medicare may make a conditional payment temporarily[3]; however, when the worker's compensation claim is paid or settled, Medicare or the other payer must be paid back.

Injuries acquired during an auto accident may be required to be sent to an auto personal injury protection (PIP) policy first before submitting claims to a healthcare payer depending on state laws and options.

When a patient is covered by Medicare or a commercial payer and Medicaid, Medicaid would be the payer of last resort. Providers must exhaust all sources of payment (Medicare, Tricare, commercial insurance, supplemental plans worker's compensation, and PIP coverage.[4] Some state's Medicaid programs will pay providers who can provide documentation that they have attempted to bill the other sources of payment but were unsuccessful after a specified period of time. These Medicaid programs have a Third-Party Liability department that will continue to attempt to recover the payment from the other payment sources.

These scenarios and others are available at https://content.naic.org/.

By Christine Hall, Senior Consultant, CHC, CPC, CPB, CPMA, CRC, CEMC, CPC-I Certified Instructor

About NAMAS

NAMAS delivers preparation classes for the AAPC CPMA® exam as well as continuing education opportunities for medical auditors. Other professionals such as coders, practice managers, physicians, mid-level providers, and compliance officers find our educational programs extremely beneficial in improving the effectiveness of their work.