Offsetting Staffing Shortage-Induced Revenue Loss

Date Posted: Wednesday,

May 11, 2022

Exacerbated by pandemic-induced burnout, the Great Resignation, vaccine mandate-driven terminations, and rising retirement rates, the chronic shortage of billing, coding, and audit professionals will continue to worsen over the near future.

And it comes at a time when demand for these positions is skyrocketing, with the American Hospital Association (AHA) projecting a 13% growth in medical records, billing, and compliance positions - the fastest growing healthcare white-collar administrative professions - by 2026.

As a result, healthcare organizations struggle to keep revenues flowing with too few qualified professionals to manage critical billing and compliance processes. The impacts are already being felt. For example, the AMA projects hospital revenue losses between $53 billion to $122 billion in inpatient revenue and another $64 billion in outpatient revenues in 2021.

These devastating figures put health systems under more significant pressure to optimize their billing, compliance, revenue cycle, and revenue integrity capabilities to improve revenue flow while outpacing reduced staffing levels that increase the risk of compliance issues and errors that cause an increase in delayed or denied claims.

An analysis by Hayes of more than $100 billion worth of denials and $2.5 billion in audited claims found that throughout the first 10 months of 2021, 40% of COVID-19-related charges were denied, and 40% of professional outpatient audits for COVID-19 and 20% of hospital inpatient audits failed.

The review of more than 50,000 providers and 900 health systems also identified bundling errors as the top culprit behind 34% of inpatient hospital charge denials, each with an average value of $5,300. Internal auditors also identified a significant number of concerns centered around disagreements between procedure codes and diagnoses, contributing to 33% of all internal audits containing "disagree" findings.

The numbers are staggering. But they can be turned around.

By examining the efforts of auditing, billing compliance, and revenue cycle teams, healthcare organizations can mitigate billing compliance risk, reduce revenue leakage, and improve cash flow, even with fewer billing and coding professionals on staff - particularly with some help from technology.

The Power of Automation

Mining and analyzing retrospective claims data can help coding teams identify and resolve compliance and revenue risks. For example, one of the organizations we work with has more than 50 facilities leveraging risk-based analytics tools to find a widespread systemic risk with modifiers being missed from its professional outpatient claims because of a lack of system edits in the billing system rules. This led to it recovering millions of dollars in lost revenue and educating the provider ecosystem beyond the ones they audited.

In contrast, prospective claims analysis can ensure correction of errors before claims leave the facility to mitigate the risk of denials and delays. Both also help identify critical risk areas and allow revenue cycle teams to identify and benchmark provider patterns without adding to the burden of billers and coders who are already stretched to their limits.

Leveraging Advanced Analytics Tools

Denials are a leading indicator of systemic billing and coding issues among many health systems. Hence, listening to the denial signals and acting upon the root causes can save millions of dollars for a health system. However, manually mining thousands upon thousands of claims lines across denials to identify problematic trends and detect anomalies in at-risk claims to accelerate the revenue cycle and improve association processes is a non-starter for resource-strapped coding, billing, and compliance departments. Thankfully, advances in automation, augmented intelligence (AI), and natural language search (NLS) make it feasible to put the power of retrospective and prospective audits to work, boosting revenues without overwhelming teams.

Specifically, advanced analytic discovery tools exist that can comb through denials within minutes and deliver actionable insights in near real-time, enabling a unified revenue integrity-based approach that uses claims data to help focus auditing efforts and reduce denials. This, in turn, allows healthcare organizations to increase the impact of existing compliance programs by more rapidly identifying and addressing risk, resulting in improved revenue flow and reduced risk of takebacks.

When these tools are integrated into a single auditing and revenue integrity platform that incorporates a robust analytics dashboard, the process is further streamlined, enhancing improvement efforts and providing an at-a-glance understanding of performance by enabling efficient prospective and retrospective audits. Further, by protecting the organization from compliance risk, optimizing reimbursements, and improving revenue retention, a solid business case exists for the required investment - a business case that can override budget constraint arguments by converting what is a cost center into a source of recovered revenues.

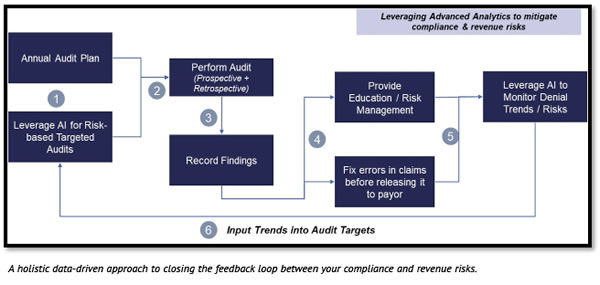

Health leaders can get out in front of these potential issues, even with understaffed coding and billing departments. The best of these approaches draws on the power of technology-enabled processes to address front and back-end auditing and contain risk associated with upcoding, bundling, and eligibility issues. See graphic below.

Closing Thoughts

Technology and automation are not silver bullets, but can be powerful tools in driving change, solving labor shortages, and accelerating outcomes when embedded with people and processes within healthcare organizations for revenue integrity programs.

Organizations can take the below outlined steps in driving successful revenue integrity outcomes:

- Define core objectives, metrics, and outcomes as part of a series of focused pilots that can be executed in an agile manner.

- Assess how effectively you are leveraging billing and payments data to identify targeted risks in the areas of compliance, coding, and denials. For example, ask yourself, "Are we closing the loop between our auditing processes and denial outcomes?"

- Train your teams in advanced analytics tools that can be successfully integrated within your defined revenue integrity processes to identify compliance and revenue risks.

- Set up a cross-disciplinary steering committee of compliance, revenue cycle, coding leaders who can learn from the data and insights and scale remediation across their functional groups.

- Scale the pilots to multiple areas of your organizations - e.g., facilities, physician groups, specific procedure and diagnosis areas, coder groups, etc.

Ritesh Ramesh is the Chief Operating Officer at Hayes and leads the customer experience and technology teams, overseeing product management, engineering, customer success, implementation/training, technical support, and security of the MDaudit Enterprise auditing and revenue integrity platform. Ritesh has more than 17 years of technology experience with deep expertise in emerging technologies, Cloud, Digital, and AI.

Before joining Hayes, Ritesh had a successful track record in the professional consulting industry, working with several business and technology leaders across multiple industries in driving next generation digital, analytics, and technology initiatives enabling customer experience improvements, revenue growth, and operational excellence in their respective businesses. Ritesh has an MBA from MIT Sloan School of Management and a Master’s in Computer Science from the Illinois Institute of Technology.