Date Posted: Tuesday,

November 15, 2016

In our current environment, medical providers are being inundated with demands

from both governmental and commercial payers. With the burden of Comparative

Billing Reports (CBRs), Additional Documentation Requests (ADRs), Pre-payment

Reviews, Post Payment Reviews, audits by ZPICs, MICs, RACs and Commercial

Payers, Denials of medical services for generic reasons such as "Not Medically

Necessary," providers oftentimes find themselves scratching their head asking:

"Is this really worth it?" Articles published in the Wall Street journal

(August 29, 2014), Forbes (September 11, 2014), The Huffington Post (May 30,

2012), Medical Economics (November 21, 2013), and a host of others over the

past 10 years reveal that a very scary percentage of physicians say that,

for a number of reasons, if they had to do it over again, they wouldn't.

And much of the discontent and unhappiness center around what they perceive

as administrative complex and clinically unnecessary rules and regulations.

This is well supported by the fact that there are issues with the contractors

who have been awarded contracts by CMS. To fact check this, you don't have

to go any further than such respected publications such as Forbes and CBS

News. Through investigative reporting, they have seen fit to produce articles

and broadcasts to highlight the issues. In addition, highly respected consultants

have submitted White Papers to the Senate Finance Committee to make their

concerns known. Before I get to the articles and White Paper, let me provide

evidence to confirm that my opinion is grounded in facts and not fairy tales.

1. The Department of Justice obtained more than $3.5 billion in settlements

and judgments from civil cases involving fraud and false claims against the

government in the fiscal year ending Sept. 30, 2015.

a. This is the fourth year in a row that the department has exceeded $3.5

billion in cases under the False Claims Act, and brings total recoveries from

January 2009 to the end of the fiscal year to $26.4 billion.

2. As of June 30, 2016 Strike Force Actions have included :

a. 1,522 Criminal Actions;

b. 2,185 Indictments; and

c. $1.98 billion in recovery

In the van Halem Group, LLC White Paper, item number 2 discusses that one

significant concern is the lack of trust between the provider community and

CMS:

CMS and its contractors often cultivate an environment of mistrust and

suspicion that all providers of certain services are inherently fraudulent.

The sentiment is widely shared by anyone that has worked with CMS contractors

in the area of program integrity and a similar environment is probable within

the CMS Program Integrity Group. This type of environment leads investigators,

contractors, and CMS to pursue providers in an aggressive manner, sometimes

unfairly, based on little evidence or collaboration of any wrongdoing.

The paper goes on to state that they have found that these contractors abuse

the use of prepayment reviews. As an example, "It is not uncommon for a Zone

Program Integrity Contractor (ZPIC) to implement a 100% prepayment review

of a provider's claims with no notification."

Simply making a statement that payers and their "Contracted Bounty Hunters"

are on a "Rampage" (Narratives provided by CBS News and Forbes) (*specific

links to these stories are provided above) is a statement most would look

at and think, "Well, sure they're aggressive," but until you see it in the

terms of actual pre- and post-payment reviews, the magnitude of the problems

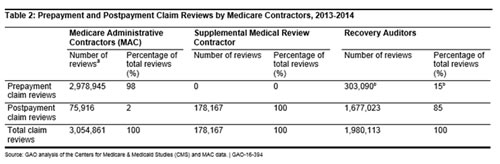

remain nuanced. The table below only takes into account MACs, SMRCs and RACs.

ZPICs, MICS, Commercial Payers, etc. are not included.

In 2015, the OIG was very critical of the Centers for Medicare and Medicaid

Services regarding the award of ZPIC Contracts and the lack of oversight for

these contractors. According to the OIG Report of the same year:

The Centers for Medicare & Medicaid Services requires potential Medicare

antifraud contractors to disclose possible conflicts of interest and strategies

for mitigating them (This information is published in multiple public reports).

But when officials from the Department of Health and Human Services Office

of Inspector General reviewed these disclosures, they identified 1,919 business

and contractual relationships as possible conflicts and 16 as actual conflicts,

according to the report. In their review, OIG investigators looked at information

from 18 offerors (companies that put in proposals for contracts) and 85 subcontractors

within CMS...Often the ZPIC contractors have had no experience in the areas

of fraud and abuse for which they should be accountable. The result is a loss

to CMS of fraud and abuse funds and providers, many of which are small – medium

sized businesses, are forced to spend thousands of dollars to address unfounded

audits and investigations. This was evidenced when CMS lost $80 million of

the $120 million paid to contractors in 2011, due to poor data when investigating

fraud and abuse...The significant lack of oversight of ZPIC contractors, who

were awarded contracts averaging $81.9 million, is evidenced by the extreme

and ill-founded actions taken by some ZPICs in unwarranted efforts to show

CMS a return on investment. Contractors often employed significant, aggressive,

and over-zealous audits, claims reviews and investigations against legitimate,

not fraudulent, providers of healthcare services. The broad brush actions

cost legitimate providers huge amounts of time, money and energy-inhibiting

their ability to provide care to beneficiaries. Some are forced to leave Medicare,

if not health care services all together. ZPICs are large and powerful corporations

with the backing of the federal government. They apply heavy handed processes

in a punitive manner to many legitimate providers over minor document infractions.

Further exacerbating the problems are the individuals employed by CMS to oversee

these contractors, who are often young and inexperienced and do not have healthcare

or fraud investigation experience.

For a couple of years now, I have talked about The Treating Physician Rule.

The first section of the Medicare statute is the prohibition "Nothing in this

title shall be construed to authorize any Federal officer or employee to exercise

any supervision or control over the practice of medicine or the manner in

which medical services are provided." From this, one could conclude that

the beneficiary's physician should decide what services are medically necessary

for the beneficiary, and a substantial line of authority in the Social Security

disability benefits area holds that the treating physician's opinion is entitled

to special weight and is binding upon the Secretary when not contradicted

by substantial evidence. Some courts have applied the rationale of the "treating

physician" rule in Medicare cases, and have rejected the Secretary's assertion

that the treating physician rule should not be applied to Medicare determinations.

In Holland v Sullivan, the court concluded:

Though the considerations bearing on the weight to be accorded a treating

physician's opinion are not necessarily identical in the disability and Medicare

context, we would expect the Secretary to place significant reliance on the

informed opinion of a treating physician and either to apply the treating

physician rule, with its component of "some extra weight" to be accorded that

opinion, [even if contradicted by substantial evidence], or to supply a reasoned

basis, in conformity with statutory purposes, for declining to do so.

In addition, audit findings may be challenged based upon the opinion of the

treating physician who is likely the target of the audit. The "Treating Physician

Rule" first arose in a context of a disability determination and holds that

an Administrative Law Judge should give greater deference to the opinion of

the treating physician than to those of non-treating physicians. The opinion

of the treating physician is particularly important when challenging the applicability

or reasonableness of a LCD.

The Van Halem Group's White Paper to the Senate Finance Committee outlined

and focused on the clinical competency of those both clinically and non-clinicians

making determinations on "Medical Necessity." Until June of 2011, CMS Section

3.4.5.C of the Medicare program Integrity Manual (Pub 100-8) guided contractors

in performing complex medical reviews.

While Medical Review (MR) staff must follow national coverage determinations

and local coverage determinations, they are expected to use their expertise

to make clinical judgments when making medical review determinations. They

must take into consideration the clinical condition of the beneficiary as

indicated by the beneficiary's diagnosis and medical history when making these

determinations. Currently, ZPIC and Medicare Administrative Contractors (MACs)

are employing clinical staff; however, they have no ability to use that expertise.

As a result, CMS is requiring and paying for clinical expertise but not receiving

the cost savings benefit of the expertise. Additionally, a provider under

review may be subject to significant claim denials and scrutiny because of

issues with insufficient documentation that are not associated with fraudulent

activity. Many denials are unfounded and irrational due to the prohibition

of allowing ZPIC's clinical staff to use their clinical judgment and expertise.

As a result, these denied claims must be appealed, often times up to the Administrative

Law Judge (ALJ) level. This process of denying claims and conducting appeals

costs the government a significant amount of money only to see a significant

number of the decisions overturned.

While medical providers are held to very strict standards with regard to documentation

and coding of services, the payers aren't, and this oftentimes leads to unethical

business practices. Take for instance the Medicare Appeals Process. After

exhausting the first 2-levels of the process (Redetermination and Reconsideration),

a practice has the right to file for an Administrative Law Judge Hearing,

which according to CMS Section 1869 of the Social Security Act and 42 C.F.R.

part 405 subpart I, OMHA ALJs began adjudicating appeals in July 2005, based

on section 931 of the MMA, which required the transfer of responsibility for

the ALJ hearing level of the Medicare claim and entitlement appeals process

from SSA to HHS. New rules at 42 CFR part 405, subpart I and subpart J were

also established to implement statutory changes to the Medicare fee-for-service

(Part A and Part B) appeals process made by the Benefits Improvement Protection

Act (BIPA) in 2000 and the Medicare Modernization Act (MMA) in 2003. Among

other things, these new rules addressed appeals of reconsiderations made by

QICs, which were created by BIPA for the Part A and Part B programs. These

rules also apply to appeals of SSA reconsiderations. The statutory changes

made by BIPA include a 90-day adjudication time frame for ALJs to adjudicate

appeals of QIC reconsideration beginning on the date that a request for an

ALJ hearing is timely filed.

In recent years, the Medicare appeals process has experienced an unprecedented

and sustained increase in the number of appeals. At OMHA, for example, the

number of requests for an ALJ hearing or review increased 1,222 percent, from

fiscal year (FY) 2009 through FY 2014. The increasing number of requests has

strained OMHA's available resources and resulted in delays for appellants

to obtain hearings and decisions. Right now, it is taking between 2-3 years

to have a case assigned to a judge and then up to another 2-3 years to have

the case heard. The biggest issue is what happens following a Qualified Independent

Contractor (QIC's) decision to uphold a redetermination, finding Medicare

has the right to demand a refund or to begin off-setting monies from future

payments. They can do this even though "due process" has not been granted

to the appellant, resulting in a finding of "guilty" by a non-binding entity

such as a contractor. These financial losses are crippling medical practices

and forcing them into uncharted waters of having to provide services for Medicare

beneficiaries without being compensated, because someone other than a judge

made a decision that their services billed were not "Medically Necessary"

or failed to support the level billed, which we all know is highly subjective.

Despite significant gains in OMHA ALJ productivity (in FY 2014, each OMHA

ALJ issued, on average, a record 1,048 decisions and an additional 456 dismissals),

and CMS and OMHA initiatives to address the increasing number of appeals,

the number of requests for an ALJ hearing and requests for reviews of QIC

and IRE dismissals continue to exceed OMHA's capacity to adjudicate the requests.

As of April 30, 2016, OMHA had over 750,000 pending appeals, while OMHA's

adjudication capacity was 77,000 appeals per year, with an additional adjudication

capacity of 15,000 appeals per year expected by the end of Fiscal Year 2016.

If this is not a sign of payers on an auditing rampage, then I am not sure

what would constitute one. In general, payers are asking physicians to provide

first-world care in the presence of third-world due process.

One of the topics I discuss during calls with clients who have been targeted

or have received adverse results from an audit or during lectures is that

they have a right to "Challenge Credentials of Reviewers." Specifically, Section

3.1.1.1 of the Medicare Integrity Manual requires that coverage determinations

be made only by RNs, LPNs, or physicians, unless the task can be delegated

to another licensed health care professional. Reviews of coding determinations,

likewise, must be made by certified coders, but should also be made by those

who possess the requisite skills in the specialty they are reviewing. Upon

receipt of disclosure of the identity and qualifications of the auditors,

request for the disclosure of the identity and qualifications of the auditors

should be made. Should the matter be escalated to an ALJ hearing, you have

the right to request formal discovery of such materials.

The van Halem Group's paper outlined the fact that "There is a lack of experience

and training of ZPIC staff." In one specific case, a member of management

at a ZPIC was questioned regarding issues surrounding numerous errors being

made by staff. The ZPIC Manager said, "Not only was he aware of the errors

being made but attributed them to issues related to workload, exhaustion,

or lack or training." The White Paper goes on to state, "Many ZPIC investigators

lack sufficient training in coverage and reimbursement policies for the services

under their review." There was a case sited in the paper where a provider

contacted their local Congressman to address concerns over incorrect denials

in a ZPIC audit. The Congressman's office contacted CMS Central Office and

submitted 11 examples of claims denied in error. The actual written response

from CMS said they agreed that 7 of the 11 claims were in fact denied erroneously.

However, the letter went on to state, "That regardless, the provider's error

rate remained high so they will remain under investigation" despite the fact

they had just received confirmation in the very same response that the error

rate calculated was incorrect because of errors made by the contractor. This

not only supports a lack of training, but a lack of appropriate oversight

and fairness."

One of the areas our firm focuses on, specifically through Frank Cohen, is

challenging the sampling and extrapolation of an audit finding. The statutory

or regulatory provision expressly authorizes the use of extrapolation. However,

"... sample adjudication represents a judicially approved procedure that can

be reconciled with existing Medicare requirements for case-by-case considering..."

Case law clearly holds that a presumption of validity attaches to the amount

of an overpayment. Thus, the burden of proof with respect to a challenge

to the statistical validity of an extrapolated demand rests squarely with

the provider. 42 U.S.C. § 1395-ddd holds that a Medicare contractor may not

use extrapolation to determine overpayment amounts absent a determination

that there is a "sustained high level of payment error or documented educational

intervention has failed to correct the payment error." Such determinations

may be made by a variety of methods including a PROBE sample or data analysis

and are not subject to administrative or judicial review. In Gentiva Health

Care Corp. v. Sebelius, 857 F.2d 1 (D.D.C. 2012), the court held that the

responsibility for determining the existence of sustained high level of payment

error or the failure of educational intervention may be delegated to contractors.

Thus, the threshold for determining whether an extrapolated demand may be

made rests with the contractor and is largely immune from review. The propriety

of demand based upon a statistically valid random sampling is well-settled

and the premise is not subject to challenge.

According to Frank Cohen, this does not, however, preclude contractors from

the responsibility to generally accepted statistical standards and guidelines.

Section 4.2 of Chapter 8 of the CMS Program Integrity Manual states the following:

"If a particular probability sample design is properly executed, i.e., defining

the universe, the frame, the sampling units, using proper randomization, accurately

measuring the variables of interest, and using the correct formulas for estimation,

then assertions that the sample and its resulting estimates are ‘not statistically

valid' cannot legitimately be made."

Cohen asserts that first of all:

That is simply a ridiculous statement; of course there are additional

reasons that one could opine that a sample is ‘not statistically valid.'

But within that paragraph, the PIM does outline six specific conditions that

must exist in order for a sample to be considered acceptable. It is simply

not enough for a sample to be just random. It is well established within

the statistical community that a random sample of a heterogeneous universe

rarely produces an appropriate sample for extrapolation. In order for the

sample to be considered as part of an extrapolation event, the sample must

be representative of the universe to which the sample results will be inferred.

This is not just statistically correct; it also concurs with good sense.

It is simply illogical to attempt to take the results of a sample that does

not statistically represent the universe and then try to extrapolate back

to that universe for the purpose of estimating the impact of those erroneous

results.

Yet, this is what happens more often than not and as a result, extrapolations

are overturned at the ALJ level at a very high rate. And when that happens,

the contractor will often appeal this to the MAC, who ends up sending it back

down to the ALJ for reconsideration. Quite often, contractors will quote

Chaves to support that the only requirement is that the sample is random,

yet that is not what the judge said:

Absent an explicit provision in the statute that requires individualized

claims adjudications for overpayment assessments against providers, the private

interest at stake is easily outweighed by the government interest in minimizing

administrative burdens; in light of the fairly low risk of error, so long

as the extrapolation is made from a representative sample and is statistically

significant, the government interest predominates. (Emphasis added.)

My job is that of a physician advocate. My assignment is to protect my

clients from what I (and they) see as unwarranted attacks on their work and

profession. I have been doing this for a long time (21 years to be exact)

and in the overwhelming number of cases, my physician clients are honest,

hard-working, competent, and caring professionals. Most came into medicine

with a single goal: to be paid reasonably for providing quality care to their

patients. At times, it feels like payers have the opposite goal: to not pay

them reasonably for providing quality care to their subscribers. Most providers

with whom I work live in the stress that sometime in the future, some payer

is going to demand that the provider repay them for some service that was

provided maybe three or four years earlier. That's plain insanity.

I don't have expectations that things will change in the near future. In

fact, along with many other well respected experts in this industry, I expect

it to continue to get worse for healthcare providers.

Sean M. Weiss, CMCO, CMPA, CPC-P, CPC, Partner/ Vice President of

Compliance, DoctorsManagement

With Contributions by: Frank Cohen, Director of Analytics and Business Intelligence

Since 1956, DoctorsManagement, a medical and health care consulting firm,

has helped physicians in all specialties with health care, dental and medical

practice management services in virtually every state across America. With

our health care and medical consulting firm’s help, you become free

to concentrate on your life's work AND your life outside of work, as well.

http://www.doctors-management.com/